When you pick up a prescription at the pharmacy, you might not realize that the price you pay isn’t just about the drug itself-it’s shaped by a complex system your employer set up long before you ever walked in. Generic drugs are the backbone of most employer health plans, not because they’re inferior, but because they’re the most effective way to keep costs down-for everyone. The FDA confirms that generic medications are just as safe and effective as brand-name versions, yet they cost 80-85% less. That’s not a guess. It’s fact. And employers are betting big on that savings.

How Your Employer’s Formulary Works

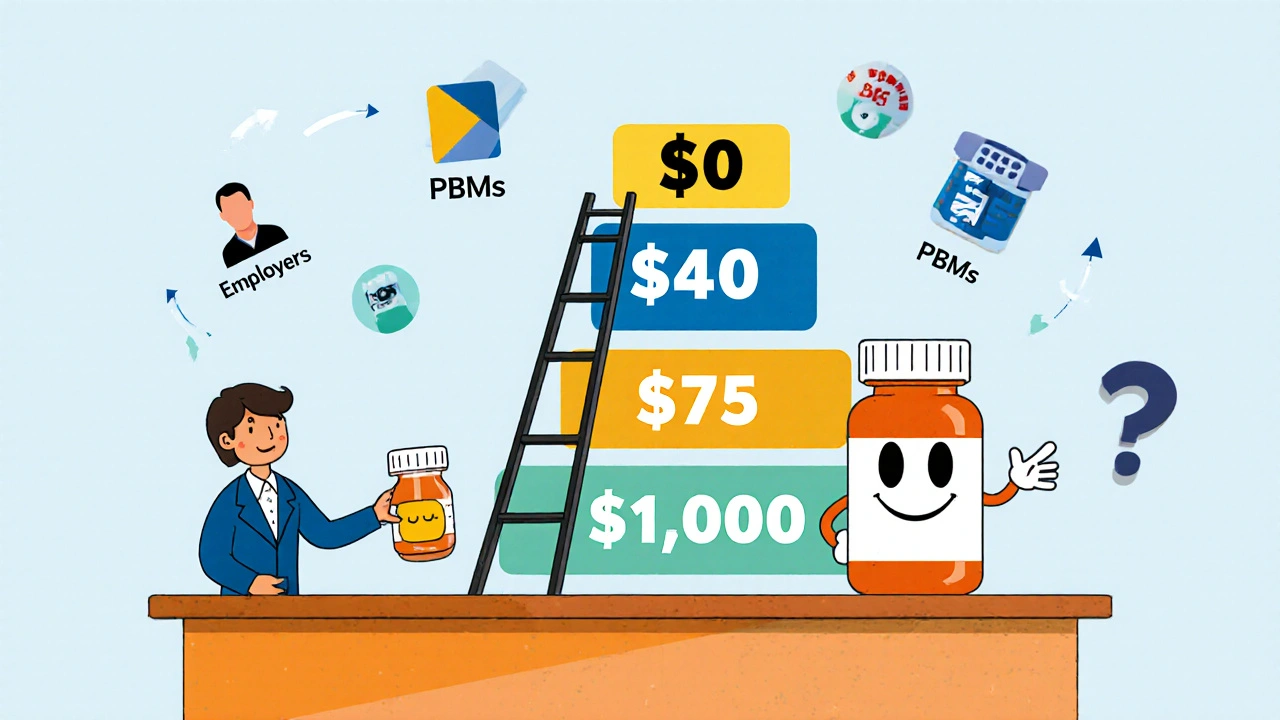

Your health plan doesn’t just cover all drugs equally. It organizes them into tiers. Think of it like a pricing ladder. The lower the tier, the less you pay out of pocket.- Tier 1: Generic drugs. Usually $10 or less per prescription.

- Tier 2: Preferred brand-name drugs. Around $40.

- Tier 3: Non-preferred brand-name drugs. Often $75 or more.

- Tier 4: Specialty drugs-for conditions like diabetes, rheumatoid arthritis, or cancer. These can cost hundreds or even thousands.

Who’s Really in Charge? The PBMs

You might think your insurer decides which drugs are covered. But the real power lies with Pharmacy Benefit Managers-OptumRx, CVS Caremark, and Express Scripts. These three companies control access to prescriptions for most large employer plans. They don’t just list drugs. They decide which ones get cut. In January 2024, each of these PBMs removed more than 600 drugs from their formularies. That’s over 1,800 medications pulled in a single month. Why? To pressure drugmakers into offering bigger rebates. These rebates are hidden from you. The drug’s list price might be $500, but after rebates, the PBM pays only $225. That 55% gap between list price and net price is called the gross-to-net spread. And here’s the catch: you don’t benefit from that discount. The savings go to the PBM and your employer. You still pay based on the original list price.Why Generics Are the Smart Choice-Even If You Don’t Realize It

Let’s say you take a medication for high blood pressure. Your doctor prescribes the brand-name version. You pay $75 a month. But there’s a generic version available. Same active ingredients. Same effectiveness. Same side effects. And it costs $10. That’s not a small difference. That’s $780 a year saved. Multiply that by thousands of employees, and you get $3 billion saved every week across the U.S. That’s over $150 billion a year. Employers aren’t doing this to be charitable. They’re doing it because healthcare costs are rising, and they need to control them. But here’s the problem: many employees don’t know generics are an option. They assume brand-name means better. Or they’re afraid the generic won’t work. That’s where communication breaks down. Employers who succeed in boosting generic use don’t just rely on fine print. They send emails. They include info in payroll stuffers. They use internal social platforms to explain: “This isn’t a downgrade. It’s the same medicine, at a fraction of the cost.”

What Happens When Your Drug Gets Removed

It’s not just about generics. It’s about access. If your medication gets pulled from the formulary, you’re suddenly responsible for the full price. No coverage. No discount. Just you and a $1,200 monthly bill. You might think, “I’ll just ask for an exception.” You can. But it’s not easy. You’ll need a letter from your doctor proving medical necessity. Even then, approval isn’t guaranteed. And if your plan uses a “closed formulary,” like some Consumer Driven Health Plans (CDHPs), your only option might be to pay out of pocket or switch drugs. Some employers offer care management programs-like HealthOptions.org’s Chronic Illness Support Program-to help employees navigate these hurdles. A care manager might find an alternative drug, help you apply for a prior authorization, or even connect you with patient assistance programs from drugmakers.How to Protect Yourself

You can’t control your employer’s plan design. But you can control how you use it.- Check your formulary. Visit your insurer’s website. Look for the “Drug List” or “Formulary.” Search your medication. See which tier it’s on.

- Ask about generics. When your doctor prescribes a brand-name drug, ask: “Is there a generic version?” If they say no, ask why. Sometimes it’s habit. Other times, there’s a real medical reason.

- Know your copays. Know what you pay for each tier. If your drug jumps from Tier 2 to Tier 4, you’ll feel it. Plan ahead.

- Use in-network pharmacies. Some plans, like HealthOptions.org’s Price Assure Program, automatically lower the cost of generics when filled at approved pharmacies. Don’t skip this step.

- Call your insurer. If you’re unsure, call. Ask: “Is this drug covered? What tier? What’s my copay? Is there a generic alternative?” Don’t assume. Verify.

The Hidden Cost of Savings

The system works-on paper. Employers save money. PBMs make profits. Drugmakers get rebates. But employees? They’re often left paying more than they should. The savings from generics don’t always show up in your wallet. The PBM keeps the rebate. Your employer keeps the savings. You get a formulary that changes without notice. It’s not broken. It’s designed that way. The goal isn’t to make drugs affordable for you-it’s to make them affordable for your employer. And in that system, generics are the tool. Not the solution.What’s Next?

Expect more exclusions. More tier shifts. More surprises. The PBMs are getting bolder. Drugmakers are fighting back. Regulators are watching the 55% gross-to-net spread. Some states are pushing for transparency laws. But until then, your best defense is knowledge. Know your plan. Know your drugs. Know your options. And don’t let silence cost you money.Are generic drugs really as good as brand-name drugs?

Yes. The FDA requires generic drugs to have the same active ingredients, strength, dosage form, and route of administration as the brand-name version. They must also meet the same strict standards for quality, purity, and performance. The only differences are in inactive ingredients-like fillers or dyes-which don’t affect how the drug works. Generic drugs are tested in labs and clinical settings to prove they work the same way. Millions of Americans rely on generics every day, and studies consistently show they’re just as effective.

Why does my copay go up when a generic becomes available?

It doesn’t-the brand-name version does. When a generic hits the market, the PBM moves the generic to Tier 1 (lowest cost) and moves the brand-name version to Tier 4 (highest cost). So if you keep taking the brand, your out-of-pocket cost jumps. It’s not a mistake. It’s intentional. The system is designed to steer you toward the cheaper option. If you don’t switch, you pay the difference.

Can my employer change my drug coverage without telling me?

Yes. Formularies change frequently-sometimes monthly. A drug can be moved to a higher tier or removed entirely without advance notice. That’s because PBMs negotiate deals with drugmakers constantly. A rebate might expire. A new generic might launch. Your plan’s rules update automatically. That’s why checking your formulary before filling a prescription is critical. Don’t wait until you’re at the pharmacy.

What if my medication isn’t on the formulary at all?

If your drug isn’t listed, your plan won’t cover it-you’ll pay full price. But you can request a formulary exception. Your doctor must submit a letter explaining why you need that specific drug (e.g., allergic reaction to generics, failure of alternatives). Approval isn’t guaranteed, but it’s your only path to coverage. Some employers offer care managers who can help you navigate this process.

Why don’t I see the savings from generic drugs in my paycheck?

Because the savings aren’t meant for you. The $3 billion saved weekly by using generics goes to your employer’s bottom line and the PBM’s profits-not your wallet. PBMs negotiate rebates from drugmakers, but those discounts don’t lower your copay. Your copay is based on the drug’s list price, not the net price after rebates. That’s why you can pay $75 for a brand-name drug even though the PBM only paid $20 for it. The system is built to reduce employer costs, not out-of-pocket expenses.

Nicole Ziegler

November 20, 2025 AT 23:28Bharat Alasandi

November 21, 2025 AT 21:54Matthew Karrs

November 23, 2025 AT 00:21Gerald Cheruiyot

November 23, 2025 AT 10:55Michael Fessler

November 23, 2025 AT 11:06daniel lopez

November 25, 2025 AT 04:34King Over

November 25, 2025 AT 20:46Johannah Lavin

November 27, 2025 AT 17:47Ravinder Singh

November 29, 2025 AT 17:30Russ Bergeman

November 30, 2025 AT 11:54Dana Oralkhan

November 30, 2025 AT 23:44