When a doctor gives you a biosimilar drug - say, a copy of Remicade for rheumatoid arthritis - how does the hospital or clinic get paid? It’s not as simple as handing in a prescription and getting reimbursed like a generic pill. Biosimilars are not generics. They’re complex biological products, made from living cells, and their billing under Medicare Part B follows a completely different set of rules than traditional generics. Understanding how this works matters because it affects what drugs get prescribed, how much providers earn, and ultimately, what patients pay out of pocket.

How Biosimilars Are Coded - Not Like Generics

In the world of small-molecule generics, one HCPCS code covers all versions of a drug. For example, generic metformin? One code, same payment, no matter the brand. Biosimilars don’t work that way. Each one gets its own unique code. If you’re giving Inflectra (a biosimilar to Remicade), you use J1745. If you give Renflexis, you use J1747. These are product-specific J-codes or temporary Q-codes assigned by CMS after FDA approval. This system changed in January 2018. Before that, all infliximab biosimilars shared one code - Q5101 - and got paid the same blended rate. That created a problem: if one biosimilar came in cheaper, the others still got paid based on the average price. No incentive to compete. The 2018 shift fixed that. Now, each biosimilar gets paid based on its own Average Selling Price (ASP).How Payment Is Calculated - The 106% Rule

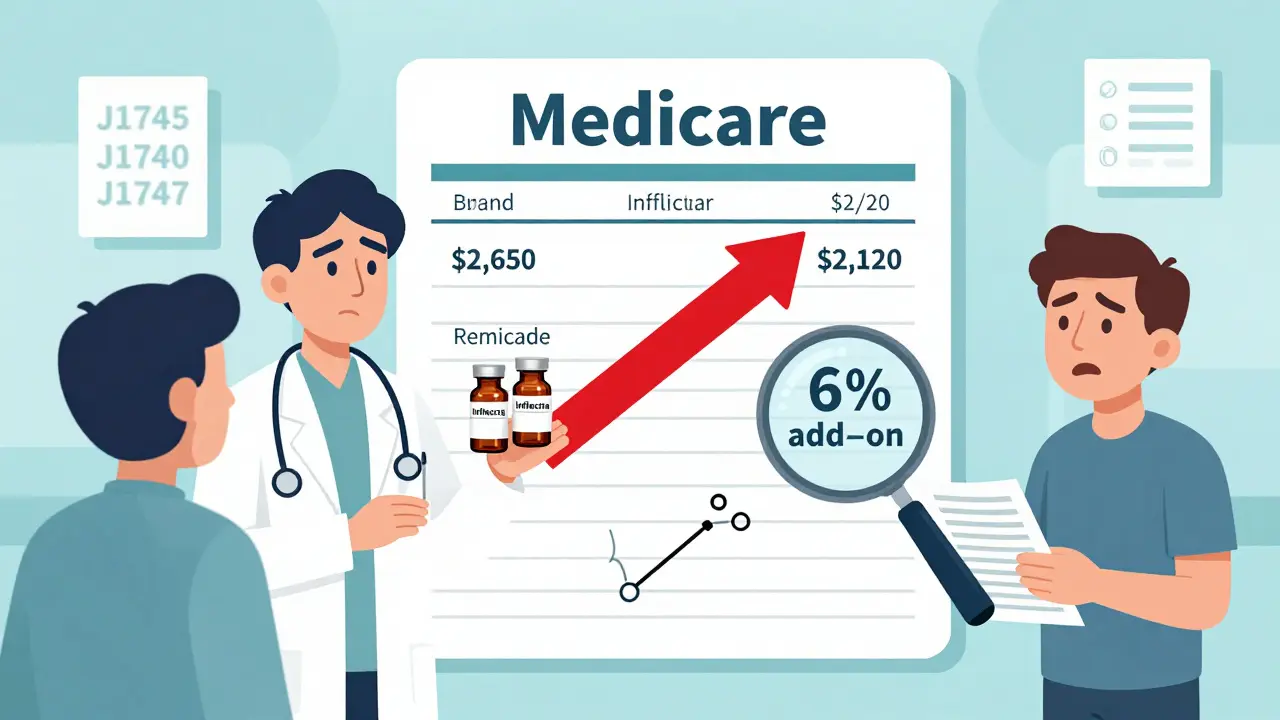

Medicare Part B pays for physician-administered drugs at 106% of the ASP. That means 100% for the drug itself, plus a 6% add-on to cover handling and administration. This rule applies to both the original biologic and every biosimilar. But here’s the catch: the 6% is calculated based on the reference product’s ASP, not the biosimilar’s. So if Remicade costs $2,500 per dose and Inflectra costs $2,000, the provider gets $2,650 for Remicade ($2,500 + 6%) but only $2,120 for Inflectra ($2,000 + 6% of $2,500). That’s a $530 difference in reimbursement per dose. That gap means providers make more money giving the more expensive drug - even if the biosimilar is clinically identical. This isn’t a glitch. It’s built into the system. And it’s one reason why adoption of biosimilars in the U.S. lags behind Europe, where payment structures reward cost savings more directly.What Happens When a New Biosimilar Enters the Market?

When the first biosimilar for a reference product hits the market, CMS uses a temporary payment method. Instead of waiting for six months of sales data to calculate ASP, they pay 106% of the Wholesale Acquisition Cost (WAC). Once enough sales data is collected - usually after six months - the payment switches to 106% of the actual ASP. After that, any new biosimilar entering the same category skips the WAC step. They go straight to the existing payment structure. For example, when Inflectra launched in 2016, it got paid based on WAC. When Renflexis came in 2017, it was immediately paid based on the blended ASP of Inflectra and Remicade. This speeds up market entry but still keeps reimbursement tied to the reference product’s price.

The JZ Modifier - A New Layer of Complexity

Starting July 1, 2023, CMS added a new requirement for infliximab and its biosimilars: the JZ modifier. This modifier tells Medicare that no drug was wasted during administration. If a provider draws up a 100mg vial but only uses 80mg, they’re supposed to report the unused portion. But if they use the whole vial - no waste - they add JZ to the claim. This sounds simple. But in practice, it’s added paperwork. One gastroenterology clinic in Ohio reported a 30% increase in billing staff time just to track discarded amounts. The modifier is meant to prevent overbilling, but it’s created a new administrative burden. And it’s only required for infliximab so far - but CMS is watching other high-volume drugs closely. If this works, expect JZ to expand.Why Providers Still Choose the Expensive Drug

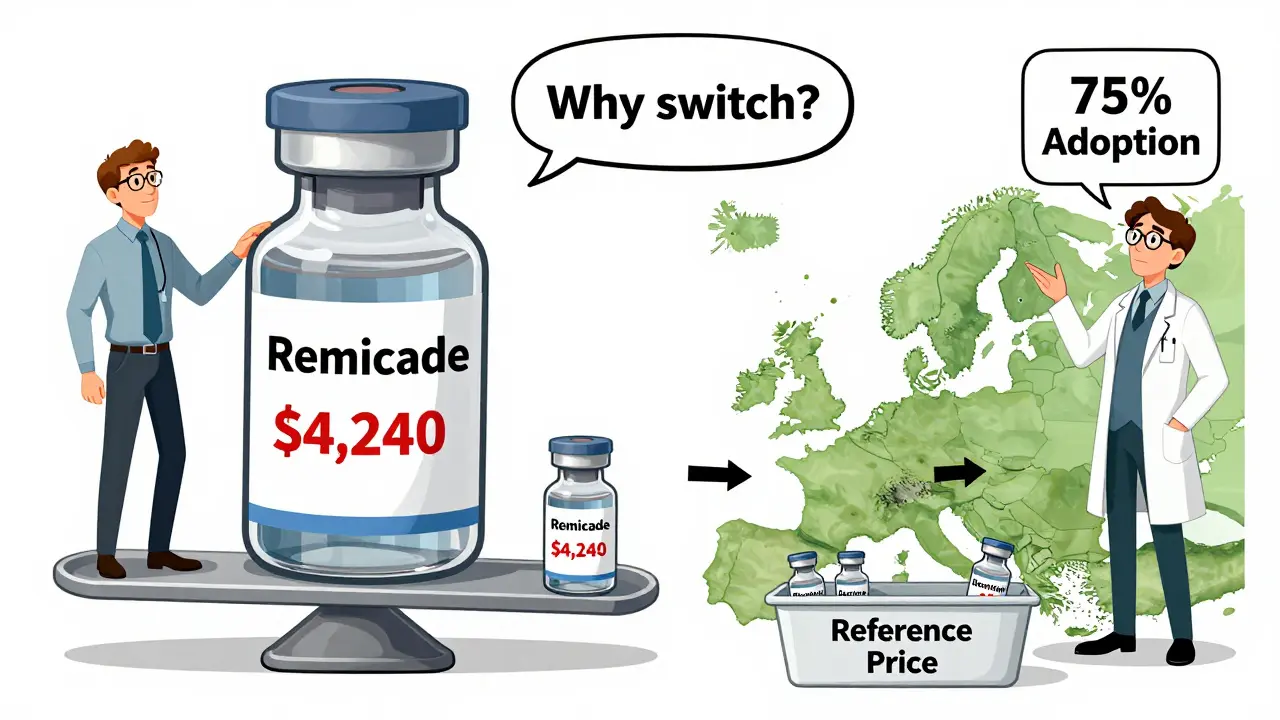

Despite the price difference, many providers still prescribe the reference biologic. A 2022 survey of 217 cancer centers found that even when biosimilars were 20% cheaper, utilization stayed below 25% for some drugs. Why? Because the 6% add-on means providers earn more per dose from the original. For a drug like Humira, which costs $4,000 per dose, the provider gets $4,240. For a biosimilar priced at $3,200, they get $3,440. That’s a $800 difference per injection. Over a year, that adds up. Hospitals and clinics aren’t charities - they need to cover overhead. And when a patient’s Medicare Advantage plan pays differently than traditional Medicare, the math gets even messier. Some plans pay 100% of ASP. Others pay 103%. Providers have to juggle multiple reimbursement rules, and often, the safest bet is to stick with the reference product.What Works for Providers - And What Doesn’t

Successful practices have learned to adapt. They use dual verification: pharmacy staff confirm the drug given matches the billing code before submission. They update their systems every quarter when CMS releases new pricing files. They train staff on the JZ modifier. One Michigan health system cut billing errors from 15% to under 3% by implementing these checks. But many smaller clinics still struggle. A 2022 survey by the Community Oncology Alliance found 68% of providers were confused during the 2018 coding switch. Forty-two percent had claims denied in the first six months. CMS provides documentation, but providers say it’s too technical. Manufacturer guides - like Fresenius Kabi’s 2023 coding handbook - are rated “helpful” by 87% of users. That’s telling. The government doesn’t always make it easy, but the companies selling biosimilars are stepping in to help.

The Bigger Picture - Why U.S. Adoption Is Still Low

The U.S. biosimilar market hit $12.3 billion in 2022, but that’s only 18% of the total biologics market. In Europe, biosimilars make up 75-85% of the same market. Why the gap? Reimbursement is a big part. European countries often use reference pricing - they pay the same amount for all drugs in a class, no matter the brand. That forces providers to choose the cheapest option. In the U.S., the 6% add-on on the reference product’s price creates a financial incentive to keep using the expensive version. Experts like Dr. Mark Trusheim at MIT have shown this structure directly undermines cost savings. If CMS removed the reference product’s ASP from the biosimilar add-on - so biosimilars got 106% of their own ASP - adoption could jump 15-20 percentage points, according to Avalere Health. That’s billions in potential savings.What’s Next? The Future of Biosimilar Billing

CMS is already looking at changes. In early 2023, they asked for public feedback on possible reforms: a fixed-dollar add-on instead of a percentage, or eliminating the reference product’s ASP from the biosimilar payment entirely. MedPAC, the advisory group to Congress, recommended in June 2023 that Medicare pay 106% of the volume-weighted average price for drugs with three or more biosimilars - a “least costly alternative” model. That’s how Europe does it. If adopted, it could push U.S. biosimilar use from 35% to 65% within five years. But there’s resistance. Biologic manufacturers argue that lower payments could slow innovation. The Congressional Budget Office estimates that full adoption of MedPAC’s plan could save Medicare $3.2 billion over ten years - but reduce biosimilar company revenues by 15-20%. It’s a trade-off: savings today versus future drug development tomorrow.Bottom Line - It’s Not Just About the Drug

Billing for biosimilars isn’t just a technical issue. It’s a financial one. The current system rewards the status quo. It doesn’t strongly incentivize switching to cheaper, equally effective drugs. Providers want to be paid fairly. Patients want affordable care. And Medicare wants to control costs. Right now, those goals are pulling in different directions. The coding is precise. The payment formulas are clear. But the incentives? They’re broken. Until the 6% add-on is recalibrated to match the biosimilar’s actual cost - not the reference product’s - adoption will stay stuck. And patients will keep paying more than they need to.Do biosimilars use the same HCPCS code as the reference biologic?

No. Each biosimilar gets its own unique HCPCS code - either a J-code (permanent) or Q-code (temporary). The reference biologic keeps its own code. For example, Remicade uses J1745, while Inflectra uses J1747. This allows Medicare to track each product’s usage and payment separately.

Why do providers get paid more for the reference biologic than the biosimilar?

Because Medicare pays 106% of the reference product’s ASP for both the original and the biosimilar. So if Remicade costs $2,500 and Inflectra costs $2,000, the provider gets $2,650 for Remicade ($2,500 + 6% of $2,500) but only $2,120 for Inflectra ($2,000 + 6% of $2,500). The 6% is based on the higher-priced reference drug, not the biosimilar’s actual cost. That creates a financial incentive to use the more expensive option.

What is the JZ modifier and why is it required?

The JZ modifier is added to claims for infliximab and its biosimilars to indicate that no drug was wasted during administration. If a full vial is used, JZ is reported. If there’s leftover drug, it’s not used. This rule, implemented in July 2023, was meant to prevent overbilling but has increased administrative work for providers, who now must track and document discarded amounts.

How often are biosimilar payment rates updated?

CMS updates biosimilar payment rates quarterly, based on the latest Average Selling Price (ASP) data. These updates are published in the Medicare Physician Fee Schedule and are effective on January 1, April 1, July 1, and October 1 each year. Providers must use the most current codes and pricing to avoid claim denials.

Are biosimilars covered differently by Medicare Advantage plans?

Yes. Traditional Medicare Part B pays 106% of ASP. But Medicare Advantage plans, which are run by private insurers, often pay differently - typically between 100% and 103% of ASP. Some plans may also require prior authorization or step therapy before covering a biosimilar. Providers must check each plan’s policy, which adds complexity to billing.

What’s the biggest barrier to biosimilar adoption in the U.S.?

The biggest barrier is the reimbursement structure. Because Medicare pays biosimilars based on the reference product’s ASP - not their own lower price - providers earn more by prescribing the original biologic. This financial incentive discourages switching, even when biosimilars are clinically equivalent and cheaper. Other countries fix this with reference pricing, but the U.S. system still favors the higher-cost drug.

Bryan Wolfe

January 11, 2026 AT 22:59This is such a clear breakdown! I work in billing at a small clinic, and the JZ modifier has been a nightmare. We had to hire an extra person just to track vial waste. I get why CMS did it, but man, the paperwork is insane. And the reimbursement gap? Oof. We’re literally losing money when we choose the cheaper biosimilar. It’s backwards.

Alice Elanora Shepherd

January 13, 2026 AT 16:04Just to clarify for those outside the US: in the UK, we use reference pricing for biosimilars - same payment regardless of brand. It’s why adoption is over 80%. The US system incentivizes the expensive option. That’s not a glitch - it’s a design flaw. Fix the payment, fix the adoption.

Christina Widodo

January 14, 2026 AT 18:09Wait - so if a biosimilar is cheaper, but you get paid based on the original drug’s price +6%, then why don’t providers just bill the original drug’s code with the biosimilar? Is that fraud? I feel like this loophole should be closed…

Prachi Chauhan

January 15, 2026 AT 10:13Let me tell you something - this whole system is built to protect big pharma. The 6% thing? That’s not about administration. That’s a bribe. Providers are not stupid. They see the math. Why would they choose the cheaper drug when the system rewards them for using the expensive one? It’s not about science. It’s about money. And money talks louder than patient care.

Katherine Carlock

January 15, 2026 AT 15:47I’ve seen this firsthand. My dad’s rheumatologist switched him to a biosimilar because it was cheaper, but the clinic charged us extra because ‘the insurance doesn’t cover it the same way.’ I was so confused. Now I get it. This isn’t just confusing - it’s unfair. Patients shouldn’t be stuck in the middle of billing politics.

Sona Chandra

January 15, 2026 AT 17:44Ugh. Another American mess. You guys have the best science in the world but you turn everything into a profit scheme. In India, we get biosimilars for 1/10th the price and doctors don’t care which one they use because we pay cash. Stop letting corporations control your healthcare. You’re being played.

Jennifer Phelps

January 16, 2026 AT 08:04beth cordell

January 17, 2026 AT 01:39So the system rewards the expensive drug… 😒 That’s like paying more for a generic soda because the brand name costs more. We need to fix this. 🙏 #BiosimilarsForAll 🌍💊

Lauren Warner

January 18, 2026 AT 06:08This entire post is a textbook case of regulatory capture. The 6% add-on isn’t accidental - it was lobbied for by biologic manufacturers. CMS doesn’t care about cost savings. They care about keeping the biotech industry happy. The JZ modifier? A distraction. Real reform? Eliminate the reference pricing entirely. But don’t hold your breath - the money’s too big.

Lelia Battle

January 19, 2026 AT 17:16It is worth noting that the current reimbursement model, while financially counterintuitive, does provide a transitional stability during market entry. The shift from blended codes to product-specific codes in 2018 was necessary to enable competition. However, the persistent reliance on the reference product’s ASP for the add-on calculation does indeed create a structural disincentive. A recalibration toward biosimilar-specific ASP would be both equitable and economically rational.

Konika Choudhury

January 21, 2026 AT 02:35Darryl Perry

January 22, 2026 AT 01:24