If you’ve ever stood at the pharmacy counter staring at a $300 bill for a prescription you can’t skip, you know how desperate people get for help. That’s where prescription discount programs and coupons come in-promising big savings, easy to use, and available right on your phone. But do they actually work? Or are they just another confusing piece of the broken U.S. drug pricing system?

What You’re Really Getting With a Coupon

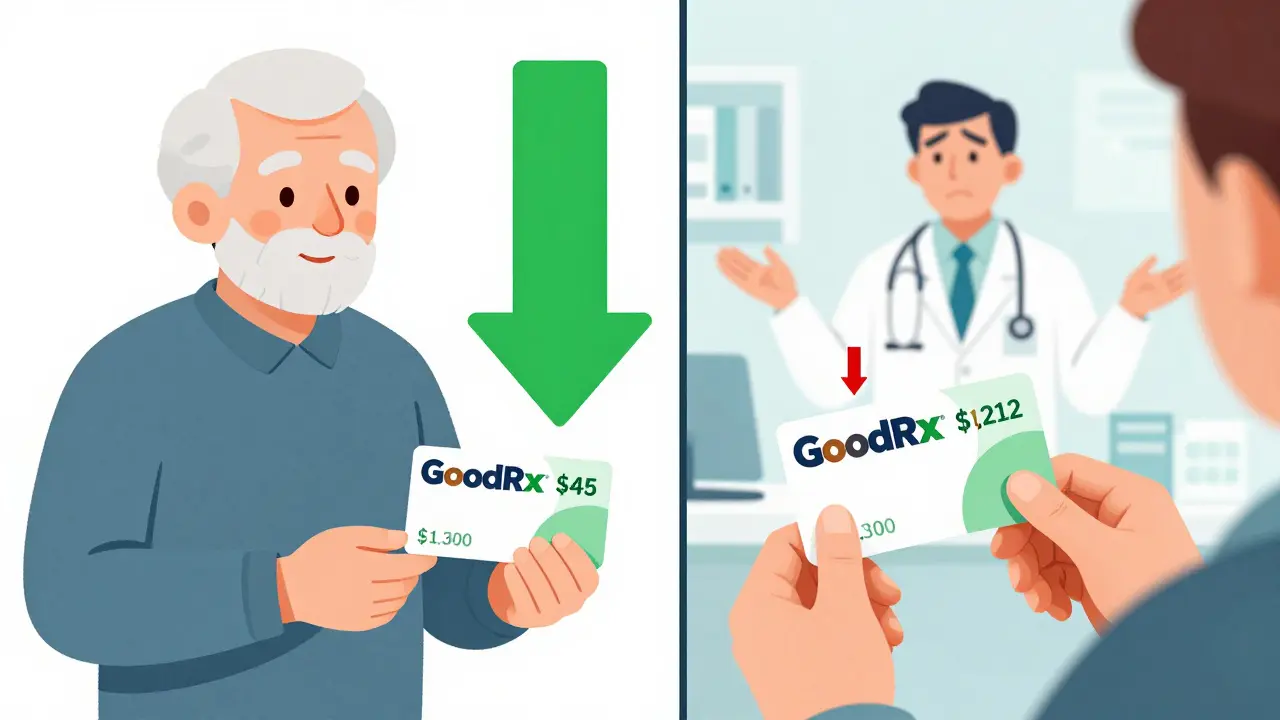

Most coupons you see online or in your doctor’s office come from drug manufacturers. They’re not free money. They’re rebates. The pharmacy still charges the full list price-say, $1,200 for a heart medication-but the coupon covers most of it, leaving you to pay $100 instead. Sounds great, right? Except here’s the catch: that $1,100 discount doesn’t go to your insurance. It goes straight to the drugmaker. And that means your insurance doesn’t count that $1,100 toward your deductible or out-of-pocket maximum. You’re still stuck paying full price next month. A 2024 JAMA Network Open study found that people using manufacturer coupons saved nearly 85% on their out-of-pocket costs. But those savings often come at a cost to the system. The same study showed that coupons were used for about 70% of all fills for a given drug. That means people aren’t switching to cheaper generics-they’re sticking with expensive brand names because the coupon makes them feel affordable. The Congressional Budget Office estimates this pushes Medicare Part D spending up by $2.7 billion a year.Third-Party Discount Cards: GoodRx and Others

This is where things get more interesting. Services like GoodRx, Blink Health, and SingleCare don’t work like manufacturer coupons. They negotiate cash prices directly with pharmacies. No insurance involved. That’s why they often crush it on generic drugs. For example, a 30-day supply of metformin might cost $45 with insurance, but GoodRx can drop it to $4. That’s not a typo. In a 2022 analysis of heart failure medications, generic drugs saw average discounts of 65% using these cards. One regimen dropped from $52.80 to $18.60. That’s real savings. And it’s why over 68% of seniors using these cards say they’re helpful. But here’s the flip side: brand-name drugs? Not so much. The same study showed brand-name discounts were barely 6.8% to 11.7%. A $1,300 prescription might drop to $1,212. That’s not saving money-that’s barely shaving off a coffee. And if your insurance already covers the brand-name drug at a low copay, using a discount card might actually cost you more.Who Benefits the Most?

The biggest winners? People without insurance. People on Medicare Part D who hit the coverage gap. People whose insurance doesn’t cover their meds at all. And people buying generics. Take the Tennessee free clinic study: over 13 months, 61 uninsured patients received 23 different medications. Total savings? $222,563. That’s $3,649 per person. That’s life-changing. These programs aren’t just helpful-they’re essential for people who have no other options. But if you’re on a typical employer plan or Medicare, things get messy. Some insurance plans won’t let you combine a manufacturer coupon with your coverage. Others will, but only if you get prior authorization. And some plans actually penalize you for using a discount card if it’s cheaper than your copay. A Blue Cross Blue Shield analysis found that 54% of members who gave up on their prescriptions because of cost later used discount cards to get them. Average savings? $18.75 per script. That’s not life-changing, but it’s enough to keep someone on their meds.

The Real Problem: Inconsistent Pricing

One of the biggest complaints about discount cards? Inconsistent prices. You check GoodRx, it says $5 for your pill at CVS. You walk in, and the pharmacist says, “Sorry, that price isn’t valid today.” That happens because pharmacies change their cash prices daily. A discount card shows you a snapshot, not a guarantee. Some locations honor it. Others don’t. A 2023 survey found 37% of negative reviews on GoodRx cited this exact issue. And pharmacists? Many aren’t trained on how to process these cards. You might have to explain it to them. Or wait while they call their corporate office. It’s frustrating. One user on Reddit reported spending 20 minutes at three different pharmacies just to get a $3 discount on a generic antibiotic.Prescription Assistance Programs: The Hidden Hero

If you’re uninsured and low-income, there’s another option most people don’t know about: Prescription Assistance Programs (PAPs). These are run by drugmakers, nonprofits, or clinics. They give you free medication. The catch? You have to qualify. Usually, you need to prove income below 400% of the federal poverty level, have no insurance, and sometimes get your doctor to fill out paperwork. It takes time. The Tennessee clinic spent 12-16 hours training staff and 3 hours per patient just to process applications. But the payoff? Free meds. No copays. No limits. For someone with diabetes, heart disease, or asthma, this can mean the difference between staying healthy and ending up in the ER.

When to Use What

Here’s a simple guide:- Use a manufacturer coupon if you have insurance that allows it and your drug has no generic alternative. But check if it counts toward your out-of-pocket max.

- Use GoodRx or similar if you’re paying cash, on Medicare Part D, or buying a generic. Always compare the card price to your insurance copay first.

- Apply for a PAP if you’re uninsured, have low income, and take a high-cost drug. Don’t assume you don’t qualify-many people do.

- Don’t use any if your insurance already gives you the drug at $5 or $10. You’re wasting time.

What’s Changing in 2025

The Inflation Reduction Act is changing the game. Starting in 2025, Medicare Part D enrollees will have a $2,000 annual cap on out-of-pocket drug costs. That means fewer people will need coupons or discount cards just to afford their meds. But here’s the twist: that cap doesn’t apply to people with private insurance. And it doesn’t stop drugmakers from raising list prices. So coupons might still be useful for them. Meanwhile, the FTC is investigating whether manufacturer coupons are anti-competitive. They might be forcing people to use expensive drugs when cheaper ones exist. If they act, we could see fewer coupons, but more generics.Bottom Line: They Work-But Only If You Use Them Right

Prescription discount programs aren’t magic. They’re tools. And like any tool, they work better for some people than others. If you’re paying cash for generics? GoodRx is a game-changer. You can save 70% or more. If you’re on Medicare and your drug costs $100 a month? A discount card might cut that in half. If you’re uninsured and on a $5,000-a-year medication? Apply for a PAP. It’s worth the paperwork. But if you’re on insurance that already gives you your brand-name drug for $15? Don’t bother with a coupon. You’re not saving anything-you’re just adding hassle. The key isn’t using a coupon. It’s knowing when to use it-and when to walk away.Do prescription discount coupons work with Medicare Part D?

You can use manufacturer coupons with Medicare Part D only if your plan allows it-and most don’t. The program was designed to prevent drugmakers from shifting costs to Medicare. However, third-party discount cards like GoodRx work fine with Medicare Part D, as long as you’re paying cash and not using your plan’s coverage. Always compare the cash price on GoodRx to your plan’s copay before deciding.

Is GoodRx better than my insurance?

Sometimes. GoodRx often beats insurance on generic drugs, especially if your plan has a high copay or deductible. For example, if your insurance charges $45 for metformin but GoodRx offers it for $4, use GoodRx. But if your insurance only charges $5, don’t use it. Always check both prices at the pharmacy counter before paying.

Why do some pharmacies say the GoodRx price isn’t valid?

Pharmacies change their cash prices daily, and discount cards show estimates, not guaranteed prices. Some locations honor the price, others don’t. It’s also possible the pharmacist isn’t trained on how to process the card. If the price doesn’t work, ask if they can check another location or call corporate. You can also try a different pharmacy nearby-prices vary even within the same chain.

Can I use a manufacturer coupon and a discount card together?

No. You can’t stack them. Manufacturer coupons are rebates that apply to the list price, while discount cards are cash prices. Pharmacies can only apply one. Usually, the discount card will be cheaper on generics, and the manufacturer coupon might be better on brand-name drugs-if your insurance allows it.

Are prescription discount programs legal?

Yes. All major programs like GoodRx, NeedyMeds, and manufacturer coupons are legal. However, some practices around them are under scrutiny. The FTC is investigating whether manufacturer coupons distort the market by pushing patients toward expensive brand-name drugs instead of generics. Medicare also has rules to prevent coupons from being used in ways that increase program costs.

How do I find a Prescription Assistance Program (PAP)?

Start at NeedyMeds.org or the Partnership for Prescription Assistance. You can search by drug name and see which programs offer free medication. You’ll need to provide proof of income, a doctor’s letter, and sometimes your tax return. It takes time, but if you qualify, you can get your medication for free. Many clinics and nonprofits also help patients apply.

Do discount programs help with brand-name drugs?

Sometimes, but not as much as you’d think. Manufacturer coupons can cut brand-name drug costs by 80% or more-but only if your insurance allows it. Third-party discount cards usually offer only 6-12% off brand-name drugs because their list prices are so high. For example, a $1,300 drug might drop to $1,212. That’s not enough to make a difference for most people. If you’re on a brand-name drug, check if a generic exists first.

Angela Goree

January 4, 2026 AT 22:00These discount programs are just another scam the pharmaceutical industry cooked up to keep prices high while making us feel like we’re getting a deal. They don’t save you money-they just shuffle the cost around so your insurance doesn’t count it toward your deductible. And don’t get me started on how they force people to stick with expensive brand names instead of generics. This isn’t healthcare-it’s corporate extortion with a coupon.

Neela Sharma

January 5, 2026 AT 04:18Life is a pharmacy shelf and we’re all reaching for the right bottle

Some with insurance, some with nothing but hope

The coupon is not magic-it’s a bridge

Between hunger and healing

Don’t judge the hand that reaches

Just ask why the shelf is so high in the first place

Liam Tanner

January 6, 2026 AT 12:24There’s real value here if you know how to use it. I’ve helped my mom navigate this for years-she’s on Medicare and GoodRx cuts her metformin from $45 to $4 every time. But I’ve also seen people waste hours trying to use manufacturer coupons on drugs that already cost $5 with insurance. It’s not about the tool-it’s about knowing when to use it. Always compare cash price vs. insurance copay before you pay. Simple.

Palesa Makuru

January 7, 2026 AT 22:17Oh please. You think this is complicated? I’ve been in pharma for 17 years. The real issue is that the FDA and CMS are too weak to regulate list prices. These coupons are a band-aid on a bullet wound. And don’t even get me started on how GoodRx profits off the chaos-those guys are basically price arbitrageurs with a slick app. Meanwhile, real patients are left playing Russian roulette with pharmacy staff who’ve never heard of a discount card. Pathetic.

Lori Jackson

January 8, 2026 AT 17:10It’s not just the coupons-it’s the entire structure. You’re supposed to believe that a $1,300 drug is worth that much because of ‘R&D’-but the R&D was funded by taxpayers, the patents are monopolies, and the marketing budgets are bigger than most countries’ healthcare systems. These ‘discounts’ are PR theater. The real solution? Single-payer. Price controls. End the patent abuse. Until then, you’re just a sucker who’s happy to save $18 on antibiotics while the system robs you blind.

Sarah Little

January 9, 2026 AT 15:41FWIW, my insurance won’t let me use a manufacturer coupon unless I get prior auth. So I just use GoodRx on generics and pay cash. Saved $300 last month on my thyroid med. But I had to go to three pharmacies because the first one said the price wasn’t valid. Why is this so hard? Someone should make a real-time API that pulls live cash prices from every pharmacy in the country. It’s 2025. This shouldn’t be a scavenger hunt.

innocent massawe

January 9, 2026 AT 20:54My sister in Nigeria pays $10 for a month’s supply of insulin. Here, same drug, $400. I don’t understand how this is normal. 😔

veronica guillen giles

January 11, 2026 AT 07:35Oh wow, a 70% discount on metformin? How revolutionary. Next you’ll tell me water is wet. Meanwhile, the same people who use GoodRx are the ones screaming about ‘big pharma’ while still using brand-name drugs because the coupon made them feel like they won the lottery. You don’t get to be a hero for saving $4 on a pill while the system burns down around you.

Tru Vista

January 11, 2026 AT 16:03GoodRx is a scam. Prices change daily. Pharmacies lie. Paperwork for PAPs is a nightmare. Just get insurance. Or move to Canada. Done.

JUNE OHM

January 13, 2026 AT 06:17Did you know the government secretly allows drugmakers to inflate list prices so coupons can look like savings? 😱 It’s all a lie. The FTC knows. The CDC knows. But they won’t tell you because they’re in on it. The real solution? Burn the system down. #FreeMedicines #PharmaIsAMafia

Philip Leth

January 13, 2026 AT 23:42I’m from the Philippines and we’ve got this thing called ‘pahingi’-you ask your cousin who works at the hospital for a discount. Sounds familiar? This whole system is just Americanized pahingi. The difference? Here, you need an app and a PhD in insurance law. Just give people the meds. No coupons. No cards. No drama.