When a hospital decides to switch from a brand-name drug to a generic version, it’s not just a simple price swap. Behind that decision is a complex, data-driven process shaped by clinical evidence, economic pressure, and strict regulatory standards. Hospitals don’t pick generics because they’re cheap-they pick them because they’ve been proven to work just as well, at a fraction of the cost. And in an era where hospital budgets are tighter than ever, that difference can mean the difference between keeping a unit open or cutting staff.

What a Hospital Formulary Really Is

A hospital formulary isn’t just a list of approved drugs. It’s a living, breathing system managed by a Pharmacy and Therapeutics (P&T) committee that meets monthly or quarterly to review new medications, evaluate existing ones, and make decisions based on three non-negotiable criteria: safety, effectiveness, and cost. This committee includes pharmacists, physicians, nurses, and sometimes even patients. Their job isn’t to save money at all costs-it’s to ensure patients get the right drug, at the right time, without unnecessary risk or expense. The modern formulary system dates back to the 1950s, when the American Society of Hospital Pharmacists (now ASHP) began standardizing how drugs were selected. Today, most hospitals use a closed or partially closed formulary, meaning only drugs on the approved list can be used unless special permission is granted. About 78% of academic medical centers operate this way, compared to just 42% of commercial health plans. That’s because hospitals need tight control over what’s given in an inpatient setting-where nurses administer drugs, patients can’t self-manage storage, and mistakes can be life-threatening.How Generics Make the Cut

Just because a drug is FDA-approved as generic doesn’t mean it automatically makes it onto a hospital formulary. The FDA says a generic is bioequivalent if it delivers the same amount of active ingredient into the bloodstream at the same rate as the brand. But hospitals don’t stop there. They dig deeper. P&T committees require manufacturers to submit full AMCP dossiers-detailed documents that include clinical studies, pharmacokinetic data, stability testing, and cost analyses. For simple oral pills, this is straightforward. But for complex generics like inhalers, injectables, or topical creams, the bar is much higher. In 2022, only 62% of complex generic applications were approved on the first try, compared to 88% for standard ones, according to the FDA’s GDUFA III report. That’s because delivery mechanisms matter. A generic inhaler might have the same active ingredient, but if the particle size or propellant differs, it won’t reach the lungs the same way. That’s not theoretical-it’s been documented in clinical settings. One hospital pharmacist in a 2023 ASHP survey said switching to a generic bronchodilator led to more rescue inhaler use among COPD patients. The drug was technically bioequivalent, but the delivery system wasn’t. That’s why hospitals don’t rely on the FDA’s green light alone-they want real-world data.The Tiered System: Why Some Generics Are Preferred Over Others

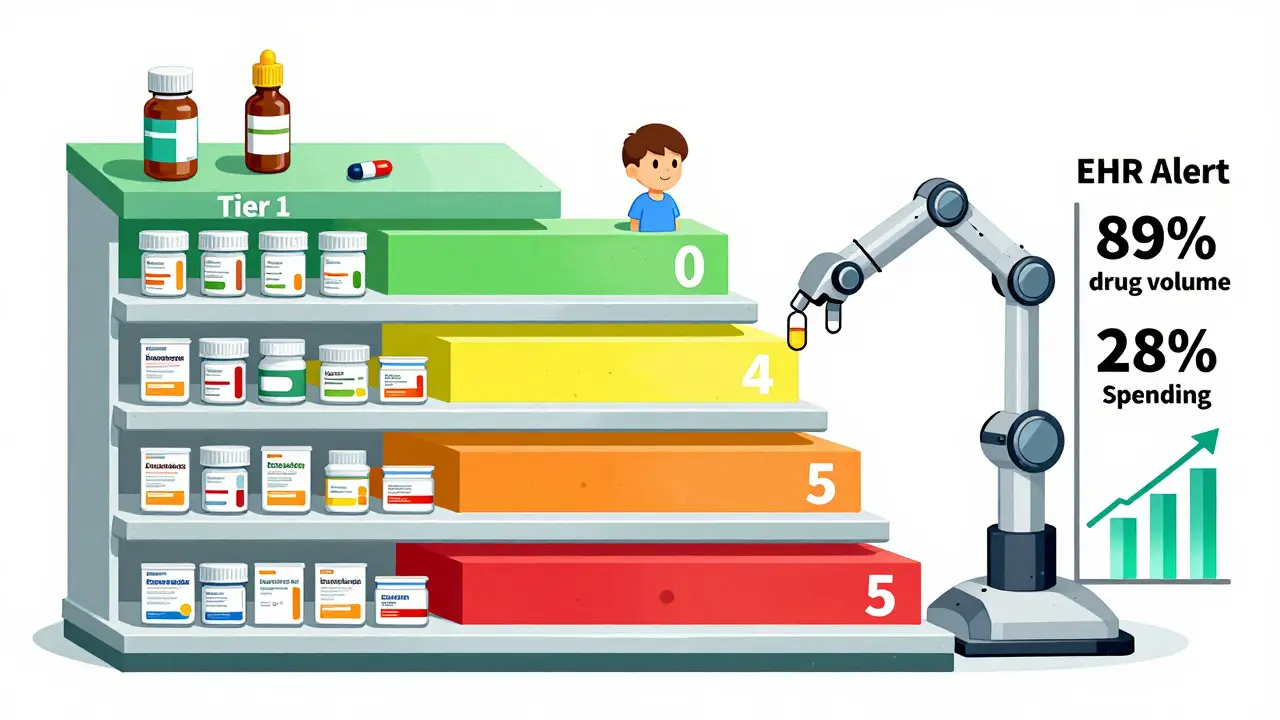

Most hospital formularies use a tiered structure to guide prescribing. Think of it like a pricing ladder:- Tier 1: Preferred generics - Lowest cost, no prior authorization needed. These are the go-to options.

- Tier 2: Non-preferred generics or preferred brands - Slightly higher cost, may require documentation.

- Tier 3: Non-preferred brands - Expensive, only used if generics fail or aren’t suitable.

- Tiers 4-5: Specialty drugs - High-cost biologics or complex generics, often requiring step therapy or prior auth.

Why Hospitals Are Different from Retail Pharmacies

Medicare Part D plans have to include at least two drugs in each of 57 therapeutic categories. Hospitals don’t. They can pick just one-if it’s the best. That’s because inpatient care is controlled. A nurse gives the medication. A pharmacist checks it. There’s no patient forgetting to take it at home or storing it in a hot bathroom. That control allows hospitals to use tools retail pharmacies can’t:- Quantity limits - Only 30 pills per discharge, not 90.

- Step therapy - Try the generic first. If it fails, then consider the brand.

- Prior authorization - Require documentation before dispensing non-formulary drugs.

The Hidden Costs of Generic Switching

It sounds simple: switch to a generic, save money. But it’s not always that clean. At Johns Hopkins, switching from a brand anticoagulant to a generic version led to unexpected complications. The generic had slightly different absorption rates. Nurses had to check INR levels more often. More blood draws meant more labor, more time, more cost. The savings on the drug were wiped out by increased staffing needs. And then there’s supply. In Q3 2023, 84% of hospital pharmacists reported at least one critical generic shortage. When a preferred generic runs out, hospitals are forced to buy non-formulary alternatives-at prices 3 to 5 times higher. That’s why many now keep backup suppliers lined up, even if they’re more expensive. It’s risk management.

What’s Changing in 2025 and Beyond

New rules are coming. The 2023 Consolidated Appropriations Act requires drug manufacturers to disclose rebates and pricing details starting January 2025. That’s going to shake up formulary decisions. Right now, many hospitals don’t know the real net cost of a drug-only the list price. Once transparency kicks in, formularies will shift dramatically. The FDA’s GDUFA III program is investing $4.3 million annually to speed up approval of complex generics. By 2026, we’ll see more generics for injectables, inhalers, and other hard-to-make drugs. That’s good news for hospitals trying to expand their formulary options. And now, some institutions are starting to use pharmacogenomics-genetic testing-to guide generic choices. At 28% of academic medical centers, they’re looking at how a patient’s DNA affects drug metabolism before deciding which generic to use. For drugs with narrow therapeutic windows-like warfarin or clopidogrel-that could mean fewer adverse events and better outcomes.What Makes a Successful Generic Program

Hospitals that get this right share a few key traits:- P&T committees with at least 50% clinical pharmacists - Not administrators. Pharmacists who actually work on the floor.

- Quarterly reviews of new generics - No waiting six months. If the FDA approves it, they review it within 90 days.

- Integration with EHRs - Only 37% of hospitals have automated alerts that pop up when a non-formulary drug is ordered. The rest rely on manual checks-and that leads to 15-20% non-compliance.

- Therapeutic interchange protocols - Cleveland Clinic created standardized rules for swapping generics, reducing acquisition costs by 18.3% without hurting outcomes.

The Bottom Line

Hospital formularies aren’t about cutting corners. They’re about cutting waste-without cutting care. Generics make up 89% of hospital drug volume but only 28% of spending. That’s the power of smart selection. But it only works when decisions are based on real clinical data, not just price tags. As drug shortages grow, rebates get more complex, and new generics enter the market, hospitals that stick to evidence, not economics alone, will keep patients safe-and their budgets intact.Are all generic drugs the same in a hospital setting?

No. While all generics must meet FDA bioequivalence standards, hospitals look beyond that. For complex drugs like injectables, inhalers, or topical creams, differences in delivery systems, excipients, or dissolution rates can affect how the drug works in the body. A generic might be chemically identical but clinically different in practice. Hospitals require real-world data and sometimes even conduct their own small studies before approving a generic for use.

Why do hospitals use closed formularies instead of open ones?

Closed formularies give hospitals control over what drugs are used in a highly monitored environment. Unlike retail pharmacies, where patients self-administer and store medications, hospitals rely on nurses and pharmacists to give drugs correctly. A closed system reduces errors, prevents overuse, and ensures all drugs have been vetted for safety and cost. About 78% of academic medical centers use closed formularies because they’re more effective in inpatient care.

How do rebates affect generic selection in hospitals?

Rebates can make a drug with a higher list price cheaper than one with a lower list price. Many generic manufacturers offer rebates tied to volume, delivery services, or clinical support. Hospitals now evaluate net cost-not list price-when making decisions. A 2023 survey found that 61% of hospital pharmacists say rebates have changed their formulary choices, sometimes overriding the lowest upfront cost.

What happens when a preferred generic goes out of stock?

When a preferred generic is unavailable, hospitals must switch to a non-formulary alternative, often at 3 to 5 times the cost. In Q3 2023, 84% of hospitals reported at least one critical generic shortage. To manage this, many now maintain backup suppliers, negotiate multi-source contracts, or temporarily allow non-formulary use with documentation. Some even stock extra inventory for high-risk, high-volume drugs.

Can pharmacists override the formulary?

Yes, but only under specific conditions. Pharmacists can override the formulary for clinical necessity-like if a patient had an allergic reaction or failed multiple generics. However, they must document the reason and often get approval from the P&T committee or a designated clinician. Automated EHR alerts help flag these overrides, but manual review is still required in most hospitals.

How do hospitals measure success in their generic programs?

Success isn’t just about cost savings. Hospitals track clinical outcomes: readmission rates, adverse drug events, length of stay, and patient satisfaction. They also monitor adherence to formulary guidelines and the frequency of non-formulary overrides. The best programs balance cost, safety, and effectiveness-proving that cheaper doesn’t mean worse.

Beth Templeton

January 6, 2026 AT 10:50Brian Anaz

January 8, 2026 AT 09:45Venkataramanan Viswanathan

January 9, 2026 AT 12:53Vinayak Naik

January 10, 2026 AT 10:07Kelly Beck

January 11, 2026 AT 06:27Molly McLane

January 12, 2026 AT 00:39Joann Absi

January 13, 2026 AT 07:46Katie Schoen

January 13, 2026 AT 10:21