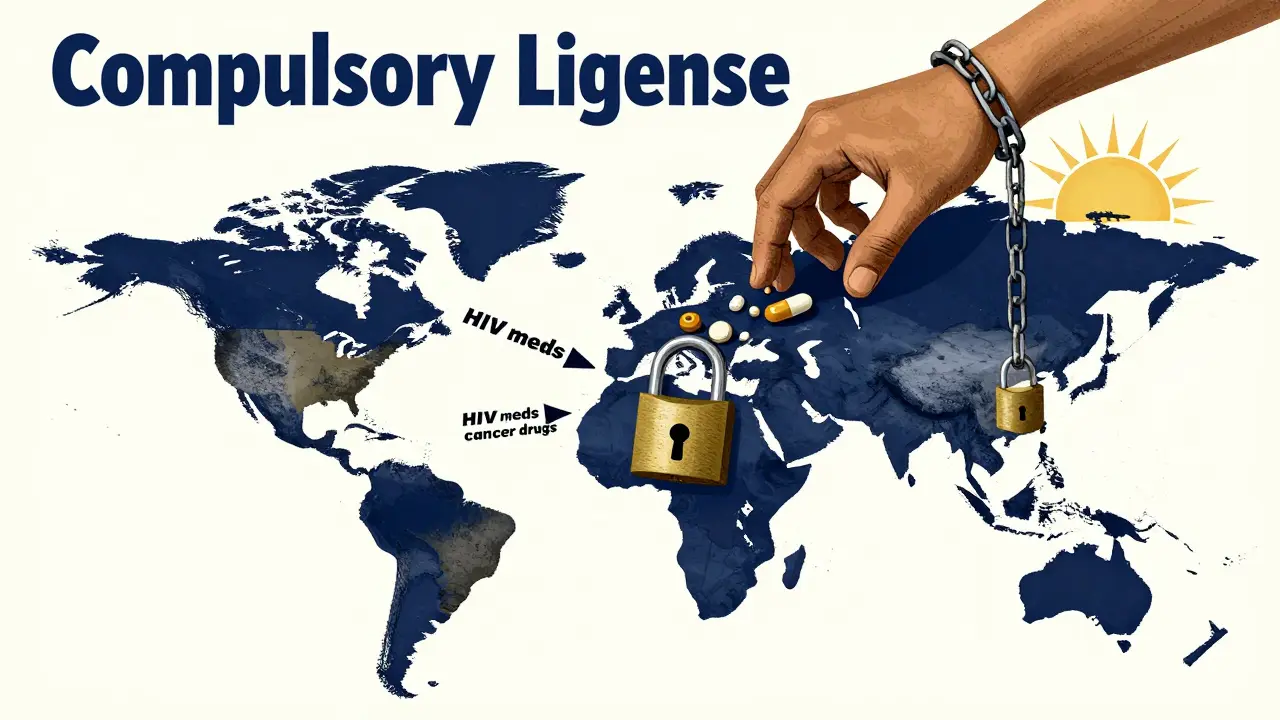

What is compulsory licensing, and why does it matter?

Compulsory licensing is a legal tool that lets governments allow other companies to make or use a patented product-like a life-saving drug-without the patent holder’s permission. The catch? The patent owner still gets paid. It’s not about stealing intellectual property. It’s about making sure people can get medicine when they need it most.

This isn’t theoretical. In 2012, India issued a compulsory license for Nexavar, a kidney and liver cancer drug made by Bayer. The original price? Over $5,500 a month. After the license, a local company started producing a generic version for about $175 a month. Thousands of patients who couldn’t afford the drug suddenly could. That’s the power of compulsory licensing.

How did compulsory licensing become part of international law?

The modern rules for compulsory licensing come from the TRIPS Agreement a 1994 global treaty under the World Trade Organization that sets minimum standards for intellectual property protection. Before TRIPS, countries could do what they wanted with patents. After 1994, they had to follow rules-but with important exceptions.

Article 31 of TRIPS says governments can issue compulsory licenses if there’s a public health emergency, if the patent isn’t being used locally, or if the patent holder refuses to license voluntarily. But there’s a catch: they usually have to try negotiating first. Except in emergencies. Then, they can skip the negotiation step entirely.

The Doha Declaration a 2001 WTO statement affirming that public health rights override patent rights in emergencies made this even clearer. It said countries have the right to use compulsory licensing to protect their populations-even if it means going against a drug company’s wishes.

How does it work in the U.S.?

The U.S. has compulsory licensing laws, but they’re rarely used. There are three main ways:

- Title 28, U.S.C. § 1498 - Lets the federal government use any patented invention without permission, as long as it pays compensation. This is how the government got access to flu antivirals during the 2009 pandemic.

- Bayh-Dole Act march-in rights - If a company got federal funding to develop a drug and isn’t making it available to the public, the government can force a license. The NIH has received 12 requests since 1980. They’ve denied all of them.

- Environmental laws - The Clean Air Act lets the government license patented pollution-control tech if it’s needed to meet air quality standards.

Between 1945 and 2020, the U.S. issued only 10 compulsory licenses-almost all under § 1498. The system works, but it’s designed to be slow and difficult. That’s by design.

How do countries like India and Brazil use it?

India has become the global leader in using compulsory licensing for medicines. Since 2005, it has issued 22 licenses-mostly for cancer drugs. The process requires proof that the patent holder hasn’t made the drug affordable or available locally. In 2013, Natco Pharma got a license to make Sorafenib, a liver cancer drug. The price dropped from $5,500 to $175 per month.

Brazil’s approach was more targeted. Between 2001 and 2017, it issued three compulsory licenses-all for HIV drugs. In 2007, it forced Merck to license efavirenz. The price fell from $1.55 per tablet to $0.48. That saved the government millions and kept thousands alive.

Thailand did something similar in the mid-2000s. It issued licenses for HIV and heart drugs, cutting prices by 65% to 90%. Abbott’s lopinavir/ritonavir went from $1,200 a year to $230. Bristol-Myers Squibb’s efavirenz dropped from $550 to $200.

Why don’t more countries use it?

Just 12 countries have ever issued a compulsory license for pharmaceuticals-even though 34 have the legal right to do so. Why?

One reason is pressure. The U.S. government has a list called the Special 301 Report an annual U.S. trade review that names countries with weak intellectual property enforcement. Countries that issue licenses often end up on it. That can lead to trade threats or delays in trade deals.

Another reason is complexity. Issuing a license isn’t just signing a paper. It requires legal expertise, manufacturing capacity, and the ability to negotiate fair compensation. The World Health Organization found that 60% of low- and middle-income countries don’t have the technical skills to do it right.

And then there’s the fear of retaliation. Drug companies threaten lawsuits. They lobby governments. They warn that compulsory licensing will kill innovation. That’s why many countries wait until a crisis hits-like a pandemic-before acting.

What happened during the COVID-19 pandemic?

When the pandemic hit, 40 countries-including Canada, Germany, and Israel-prepared to issue compulsory licenses for vaccines, tests, and treatments. Some, like Spain, passed emergency laws that waived the need to negotiate with patent holders.

But here’s the irony: very few actually used them. Why? Because vaccine manufacturers made voluntary deals. Moderna pledged not to enforce its patents during the pandemic. Pfizer and BioNTech offered low-cost licenses to middle-income countries.

Still, the threat worked. In many cases, companies lowered prices just to avoid being forced to license. That’s the silent power of compulsory licensing-it doesn’t always need to be used to be effective.

What’s changing now?

In June 2022, the WTO agreed to a temporary waiver for COVID-19 vaccine patents. It lets developing countries produce vaccines without permission until 2027. But so far, only 12 facilities in 8 countries have been approved to use it. The process is still too slow.

The European Union is pushing new rules. Its 2023 Pharmaceutical Strategy says drug companies must respond to licensing requests within 30 days-or risk an automatic compulsory license.

Meanwhile, the WHO is drafting a new Pandemic Treaty. Draft Article 12 would make compulsory licensing automatic during declared global health emergencies. No negotiation. No delays. Just access.

Does it hurt innovation?

Drug companies say yes. A 2018 study in the Journal of Health Economics found that countries with active compulsory licensing programs saw 15-20% less pharmaceutical R&D investment. The IFPMA claims each license announcement causes an 8.2% drop in stock prices for affected companies.

But critics point out that most compulsory licenses target drugs that are already profitable. The real problem isn’t innovation-it’s pricing. In the U.S., a single course of cancer drugs can cost over $100,000. In India, the same drug costs $1,500 after a license.

Dr. Brook Baker, a law professor, says the threat of compulsory licensing has already forced voluntary price cuts on 90% of HIV drugs since 2000. That’s not killing innovation. That’s making it serve people.

Who benefits-and who pays?

Generic manufacturers win. Teva Pharmaceutical made $3.2 billion extra between 2015 and 2020 from drugs produced under compulsory licenses.

Patients win. In low-income countries, compulsory licensing cut the price of first-line HIV drugs by 92% between 2000 and 2020.

Governments win. They save billions on public health spending. Brazil saved $1.2 billion on HIV drugs between 2001 and 2017 thanks to its licenses.

Patent holders still get paid. In India, compensation is 6% of net sales. In the U.S., courts use the Georgia-Pacific factors to calculate fair royalties-15 criteria including comparable licenses and market demand.

The real cost? It’s not money. It’s political will. Most countries don’t issue licenses because they’re afraid of trade pressure, not because the law won’t let them.

What’s next for compulsory licensing?

Experts predict a 40% increase in compulsory licensing between 2023 and 2028. Why? Antimicrobial resistance. Climate adaptation tech. Mental health drugs. These are the next frontiers.

By 2030, 75% of licenses will likely be limited to emergencies or specific diseases-not broad, open-ended use.

The key will be speed and clarity. Countries that build fast, transparent systems will get the drugs they need. Those that wait for crises will pay more-in lives and money.

Jay Tejada

January 4, 2026 AT 21:55Allen Ye

January 6, 2026 AT 06:02Justin Lowans

January 6, 2026 AT 13:35Michael Rudge

January 8, 2026 AT 09:53Jack Wernet

January 10, 2026 AT 01:25bob bob

January 10, 2026 AT 04:20Abhishek Mondal

January 10, 2026 AT 08:36Oluwapelumi Yakubu

January 11, 2026 AT 14:29en Max

January 13, 2026 AT 09:58Vikram Sujay

January 13, 2026 AT 14:12Mandy Kowitz

January 13, 2026 AT 15:04Roshan Aryal

January 14, 2026 AT 01:37Jason Stafford

January 15, 2026 AT 17:20Enrique González

January 16, 2026 AT 08:16Aaron Mercado

January 18, 2026 AT 06:24